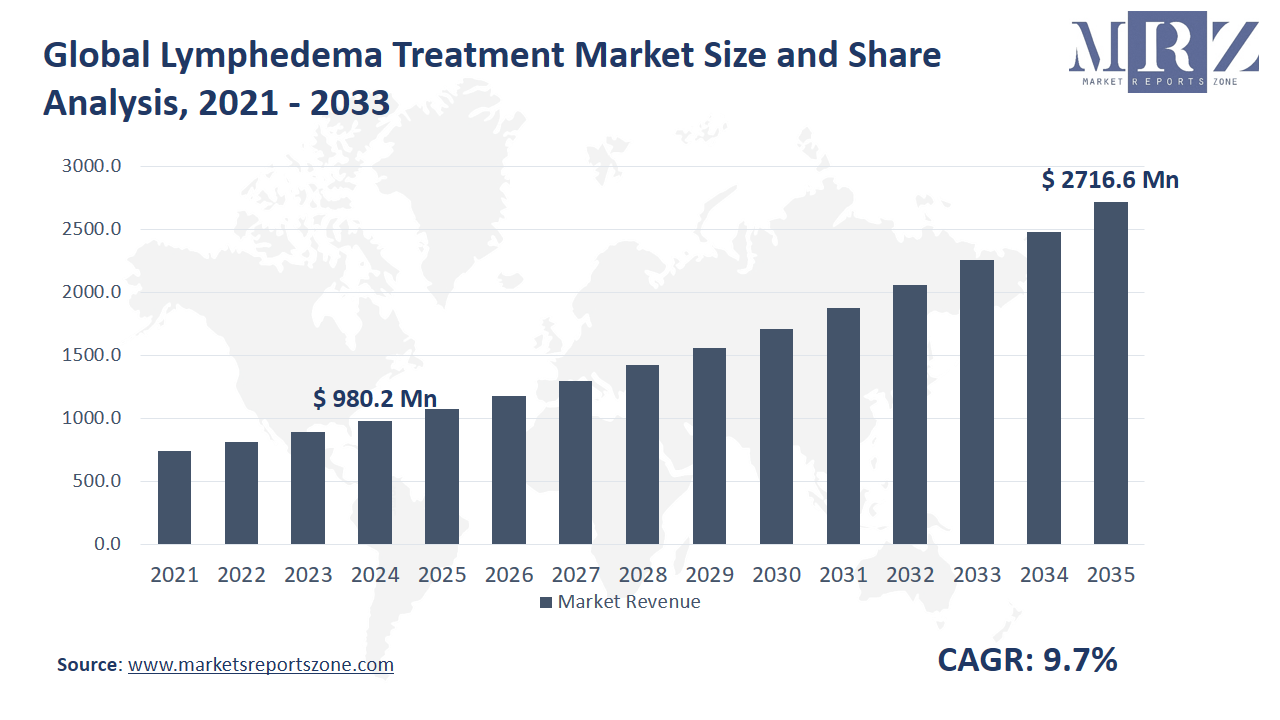

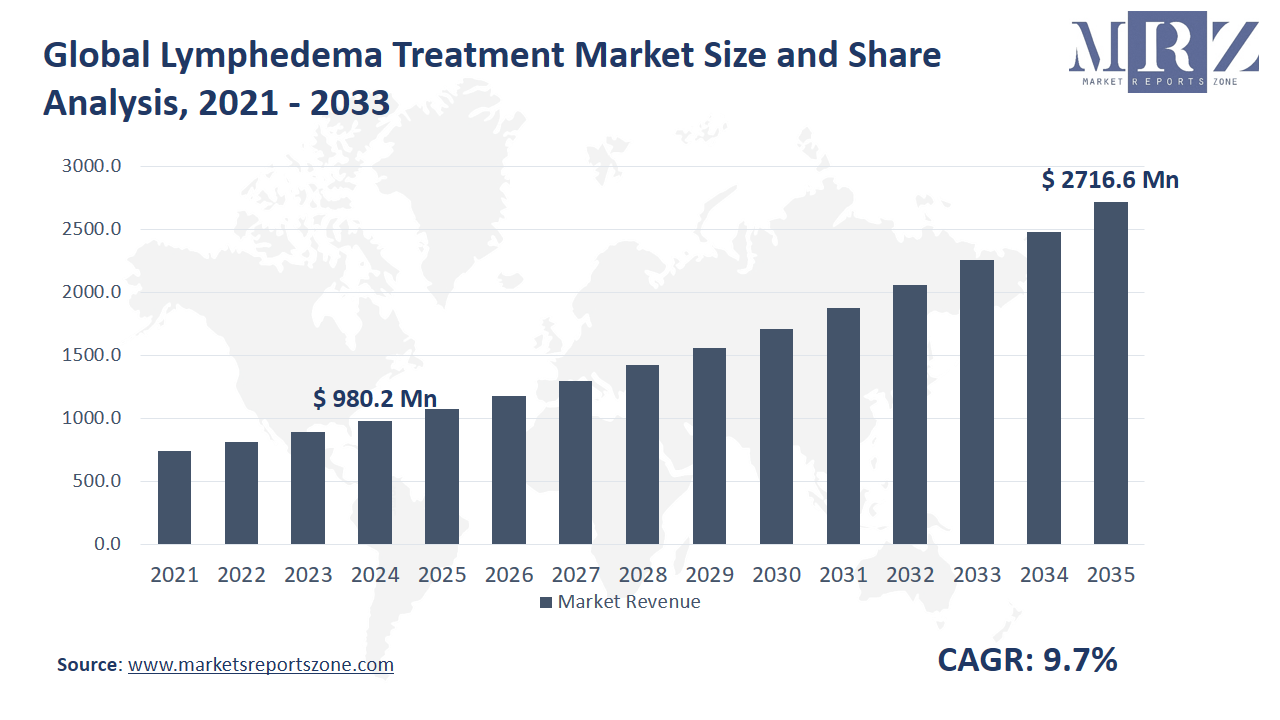

Global Lymphedema Treatment Market Size is expected to reach USD 2716.6 Million by 2035 from USD 980.2 Million in 2024, with a CAGR of around 9.7% between 2024 and 2035. A steady rise in global lymphedema cases has been observed, and greater adoption of early diagnostic tools has been encouraged, so strong demand has been created as a key driver. Increased awareness among patients about long-term swelling complications has also been promoted, and better access to compression therapies has been supported, so treatment acceptance has been pushed further. However, limited reimbursement for advanced procedures has been reported, and high therapy costs have been noted, so wider adoption has been restricted in many regions. New opportunities have been created as personalized compression solutions have been introduced, and wearable monitoring devices have been developed, so continuous symptom tracking has been enabled.

Growing interest in home-based care programs has also been stimulated, and digital platforms for remote physiotherapy guidance have been expanded, so treatment convenience has been increased. Real examples have been demonstrated as pneumatic compression pumps have been used by breast-cancer survivors to manage chronic swelling, and lymphatic bypass surgeries have been adopted by advanced care centers to reduce fluid buildup. Additional momentum has been supported as community clinics have begun offering low-cost manual lymphatic drainage sessions, and telehealth consultations have been used by rural patients to maintain therapy continuity.

Driver: Smarter Screening Tools Transform Lymphedema Care

Growing adoption of early diagnostic tools has been recognized as a major driver because subtle lymphatic dysfunction is now being identified before severe swelling develops. Consistent use of limb-volume scanners has been encouraged in oncology clinics, and rapid bioimpedance assessments has been applied during routine follow-ups, so early structural changes have been detected with greater accuracy. Faster identification has allowed preventive measures to be initiated, and mild compression routines have been introduced sooner, so worsening symptoms have been reduced. Real life progress has been illustrated in gynecologic cancer units where quick handheld scanners have been employed to monitor patients after lymph node removal, and preventive care sessions have been scheduled as soon as abnormal readings have been observed. Additional impact has been demonstrated in sports medicine centers where athletic trainers have used portable lymphatic assessment devices on injured players to detect early fluid accumulation, and tailored rehabilitation plans have been designed to prevent long-term complications. Primary care teams have also integrated simple circumference-tracking apps into routine checkups, and subtle changes in limb symmetry have been flagged early, so referrals to lymphedema specialists have been made without delay to ensure timely and effective support.

Key Insights:

- Globally, as many as 16.02 million people have lymphedema due to LF (out of ~120 million global LF cases).

- In 2020-21, there were 9,400 hospitalisations in Australia with lymphoedema as a principal or additional diagnosis.

- In a 2023 report from India, there were 619,426 lymphedema cases reported in endemic states.

- In a district-level survey in an endemic region of Odisha, 1.3% of the surveyed population reported lymphedema (17,036 out of 1,298,576 people).

- In a retrospective study over 4 years in a region, 3,725 lymphedema cases were recorded, with 55.2% being male and 44.8% female.

- In patients treated for breast cancer, about 21.4% developed lymphedema.

- In another source, secondary lymphedema (often due to cancer or other conditions) is said to affect up to 250 million people worldwide (as an estimate).

- In a morbidity-survey of an endemic area, of those reporting lymphedema, about two-thirds were in early stages of the disease.

- In follow-up of cancer patients (diverse cancers), about one-third (≈ 33%) reported lymphedema symptoms.

- A compression pump system such as Pneumatic Compression Device Leg Pump Machine for Lymphedema uses sequential/chambered compression sleeves to apply rhythmic pressure that helps move lymph fluid from limbs toward the torso.

Segment Analysis:

A broad shift in lymphedema management has been observed across treatment types, and stronger preference for compression therapy has been noted, as daily wear sleeves and flat-knit garments have been prescribed for patients recovering from gynecologic cancer surgeries. Surgical options such as lymphaticovenous anastomosis have also been adopted, and greater demand for laser therapy has been recognized in patients needing gentler, non-invasive relief. Pharmacologic therapy has been used more selectively, and targeted anti-inflammatory regimens have been introduced for chronic swelling. Multi-modal home therapy devices have gained traction, and compact pumps with adjustable chambers have been used by remote-area patients who cannot travel frequently. Both secondary and primary lymphedema have been managed differently, and more severe fluid buildup after prostate cancer procedures has been addressed with combined therapy plans. Lower-extremity cases have been commonly treated with sequential compression boots, and upper-extremity cases have been supported with arm-focused garments designed for post-mastectomy swelling. Genital lymphedema cases have been treated with customized garments crafted in specialized clinics. Hospitals have led complex surgeries, while specialty clinics have handled long-term therapy programs, and ambulatory surgical centers have performed minimally invasive procedures. Homecare settings have expanded self-managed routines, offering greater independence for chronic patients.

Regional Analysis:

Across major regions, lymphedema care has been shaped by different healthcare capacities and patient needs, and varied treatment patterns have been observed as systems adapt. In North America, wider use of imaging-based diagnosis has been encouraged, and early-stage cases have been managed through structured rehabilitation programs, as seen in community centers supporting patients recovering from melanoma surgeries. In Europe, specialized lymphatic clinics have been expanded, and advanced microsurgeries have been incorporated more routinely, as reflected in hospitals assisting patients with long-term swelling after vascular procedures. In Asia-Pacific, rising cancer survivorship has increased the need for compression garments, and outreach programs in both urban and semi-rural areas have been organized, where patients have been guided to use simple self-massage routines to control early symptoms. In Latin America, access to low-cost therapy supplies has been improved, and public hospitals have begun offering shared physiotherapy sessions, helping individuals with leg swelling related to chronic infections. In the Middle East and Africa, awareness campaigns have been strengthened, and manual lymphatic drainage has been taught in small rehabilitation units, particularly for women who developed swelling after gynecologic surgeries. Across all regions, early intervention, patient education, and growing adoption of home-based care have been emphasized to support long-term management.

Competitive Scenario:

In recent years, several leading firms — including Tactile Medical, SIGVARIS GROUP, medi GmbH & Co. KG, AIROS Medical Inc., Bio Compression Systems, Inc., Huntleigh Healthcare Ltd. (Arjo), and several smaller niche players such as Koya Medical — have moved the field toward more patient‑friendly, technology‑driven, and home‑focused care. Tactile Medical has recently rolled out next‑generation pneumatic compression devices designed for home use, improving portability and comfort, and enabling remote monitoring for chronic lymphedema sufferers. Meanwhile, SIGVARIS and medi have upgraded their compression garment lines with improved materials, fit options, and comfort features to support longer‑term daily wear. AIROS Medical has expanded its sequential compression offerings to cover more body regions, reflecting demand from diverse patient needs. Bio Compression Systems has raised production capacity to respond to growing demand, hinting at broader availability and perhaps lower cost barriers. At the same time, Huntleigh (Arjo) and other device makers are refining device usability and institutional delivery, which helps hospitals, clinics, and home‑care providers incorporate effective lymphedema management. Smaller innovators like Koya Medical are exploring wearable, mobility‑friendly compression wearables — a potential game‑changer for active patients who need therapy while working or moving. Altogether, these developments signal a shift toward decentralized, patient‑centric therapy — blending traditional compression garments, advanced pneumatic devices, and increasingly smart, comfortable, and accessible tools for long‑term management.

Lymphedema Treatment Market Report Scope

| Report Attribute | Details |

|---|

| Market Size Value in 2024 | USD 980.2 Million |

| Revenue Forecast in 2035 | USD 2716.6 Million |

| Growth Rate | CAGR of 9.7% from 2025 to 2035 |

| Historic Period | 2021 - 2024 |

| Forecasted Period | 2025 - 2035 |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Regions Covered | North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

| Countries Covered | U.S.; Canada; Mexico, UK; Germany; France; Spain; Italy; Russia; China; Japan; India; South Korea; Australia; Southeast Asia; Brazil; Argentina; Saudi Arabia; UAE; South Africa |

| Key companies profiled | medi GmbH & Co. KG; PAUL HARTMANN AG; 3M Company; AIROS Medical Inc.; Riancorp Pty Ltd; KOYA Medical; Huntleigh Healthcare Ltd. (Arjo); Tactile Medical; Mego Afek Ltd.; SIGVARIS GROUP; ThermoTek Inc.; L&R Group; HERANTIS PHARMA Plc; Bio Compression Systems Inc.; Lympha Press; BiaCare Medical LLC; Others |

| Customization | Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

The Global Lymphedema Treatment Market report is segmented as follows:

By Treatment Type,

- Compression Therapy

- Surgery

- Laser Therapy

- Pharmacologic Therapy

- Multi-modal Home Therapy Devices

- Other Treatment Types

By Type,

- Secondary Lymphedema

- Primary Lymphedema

By Affected Area,

- Lower Extremity

- Upper Extremity

- Genitalia

By End User,

- Hospitals

- Specialty Clinics

- Ambulatory Surgical Centers

- Homecare Settings

- Other End Users

By Region,

- North America

- Europe

- UK

- Germany

- France

- Spain

- Italy

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Rest of Middle East and Africa

Key Market Players,

- medi GmbH & Co. KG

- PAUL HARTMANN AG

- 3M Company

- AIROS Medical Inc.

- Riancorp Pty Ltd

- KOYA Medical

- Huntleigh Healthcare Ltd. (Arjo)

- Tactile Medical

- Mego Afek Ltd.

- SIGVARIS GROUP

- ThermoTek Inc.

- L&R Group

- HERANTIS PHARMA Plc

- Bio Compression Systems Inc.

- Lympha Press

- BiaCare Medical LLC

- Others

Frequently Asked Questions

The Global Lymphedema Treatment Market Size is expected to reach USD 2716.6 Million by 2035 from USD 980.2 Million in 2024.

The Global Lymphedema Treatment Market is expected to grow at a compounded annual growth rate of 9.7% between 2024 and 2035.

The North America holds the largest market share in the global Lymphedema Treatment Market in 2024.

Key players profiled in the global Lymphedema Treatment market are medi GmbH & Co. KG; PAUL HARTMANN AG; 3M Company; AIROS Medical Inc.; Riancorp Pty Ltd; KOYA Medical; Huntleigh Healthcare Ltd. (Arjo); Tactile Medical; Mego Afek Ltd.; SIGVARIS GROUP; ThermoTek Inc.; L&R Group; HERANTIS PHARMA Plc; Bio Compression Systems Inc.; Lympha Press; BiaCare Medical LLC; Others.

Research Objectives

- Proliferation and maturation of trade in the global Lymphedema Treatment.

- The market share of the global Lymphedema Treatment, supply and demand ratio, growth revenue, supply chain analysis, and business overview.

- Current and future market trends that are influencing the growth opportunities and growth rate of the global Lymphedema Treatment.

- Feasibility study, new market insights, company profiles, investment return, market size of the global Lymphedema Treatment.

Chapter 1 Lymphedema Treatment Market Executive Summary

- 1.1 Lymphedema Treatment Market Research Scope

- 1.2 Lymphedema Treatment Market Estimates and Forecast (2021-2035)

- 1.2.1 Global Lymphedema Treatment Market Value and Growth Rate (2021-2035)

- 1.2.2 Global Lymphedema Treatment Market Price Trend (2021-2035)

- 1.3 Global Lymphedema Treatment Market Value Comparison, by Treatment Type (2021-2035)

- 1.3.1 Compression Therapy

- 1.3.2 Surgery

- 1.3.3 Laser Therapy

- 1.3.4 Pharmacologic Therapy

- 1.3.5 Multi-modal Home Therapy Devices

- 1.3.6 Other Treatment Types

- 1.4 Global Lymphedema Treatment Market Value Comparison, by Type (2021-2035)

- 1.4.1 Secondary Lymphedema

- 1.4.2 Primary Lymphedema

- 1.5 Global Lymphedema Treatment Market Value Comparison, by Affected Area (2021-2035)

- 1.5.1 Lower Extremity

- 1.5.2 Upper Extremity

- 1.5.3 Genitalia

- 1.6 Global Lymphedema Treatment Market Value Comparison, by End User (2021-2035)

- 1.6.1 Hospitals

- 1.6.2 Specialty Clinics

- 1.6.3 Ambulatory Surgical Centers

- 1.6.4 Homecare Settings

- 1.6.5 Other End Users

Chapter 2 Research Methodology

- 2.1 Introduction

- 2.2 Data Capture Sources

- 2.2.1 Primary Sources

- 2.2.2 Secondary Sources

- 2.3 Market Size Estimation

- 2.4 Market Forecast

- 2.5 Assumptions and Limitations

Chapter 3 Market Dynamics

- 3.1 Market Trends

- 3.2 Opportunities and Drivers

- 3.3 Challenges

- 3.4 Market Restraints

- 3.5 Porter's Five Forces Analysis

Chapter 4 Supply Chain Analysis and Marketing Channels

- 4.1 Lymphedema Treatment Supply Chain Analysis

- 4.2 Marketing Channels

- 4.3 Lymphedema Treatment Suppliers List

- 4.4 Lymphedema Treatment Distributors List

- 4.5 Lymphedema Treatment Customers

Chapter 5 COVID-19 & Russia–Ukraine War Impact Analysis

- 5.1 COVID-19 Impact Analysis on Lymphedema Treatment Market

- 5.2 Russia-Ukraine War Impact Analysis on Lymphedema Treatment Market

Chapter 6 Lymphedema Treatment Market Estimate and Forecast by Region

- 6.1 Global Lymphedema Treatment Market Value by Region: 2021 VS 2023 VS 2035

- 6.2 Global Lymphedema Treatment Market Scenario by Region (2021-2023)

- 6.2.1 Global Lymphedema Treatment Market Value Share by Region (2021-2023)

- 6.3 Global Lymphedema Treatment Market Forecast by Region (2024-2035)

- 6.3.1 Global Lymphedema Treatment Market Value Forecast by Region (2024-2035)

- 6.4 Geographic Market Analysis: Market Facts and Figures

Chapter 7 Global Lymphedema Treatment Competition Landscape by Players

- 7.1 Global Top Lymphedema Treatment Players by Value (2021-2023)

- 7.2 Lymphedema Treatment Headquarters and Sales Region by Company

- 7.3 Company Recent Developments, Mergers & Acquisitions, and Expansion Plans

Chapter 8 Global Lymphedema Treatment Market, by Treatment Type

- 8.1 Global Lymphedema Treatment Market Value, by Treatment Type (2021-2035)

- 8.1.1 Compression Therapy

- 8.1.2 Surgery

- 8.1.3 Laser Therapy

- 8.1.4 Pharmacologic Therapy

- 8.1.5 Multi-modal Home Therapy Devices

- 8.1.6 Other Treatment Types

Chapter 9 Global Lymphedema Treatment Market, by Type

- 9.1 Global Lymphedema Treatment Market Value, by Type (2021-2035)

- 9.1.1 Secondary Lymphedema

- 9.1.2 Primary Lymphedema

Chapter 10 Global Lymphedema Treatment Market, by Affected Area

- 10.1 Global Lymphedema Treatment Market Value, by Affected Area (2021-2035)

- 10.1.1 Lower Extremity

- 10.1.2 Upper Extremity

- 10.1.3 Genitalia

Chapter 11 Global Lymphedema Treatment Market, by End User

- 11.1 Global Lymphedema Treatment Market Value, by End User (2021-2035)

- 11.1.1 Hospitals

- 11.1.2 Specialty Clinics

- 11.1.3 Ambulatory Surgical Centers

- 11.1.4 Homecare Settings

- 11.1.5 Other End Users

Chapter 12 North America Lymphedema Treatment Market

- 12.1 Overview

- 12.2 North America Lymphedema Treatment Market Value, by Country (2021-2035)

- 12.2.1 U.S.

- 12.2.2 Canada

- 12.2.3 Mexico

- 12.3 North America Lymphedema Treatment Market Value, by Treatment Type (2021-2035)

- 12.3.1 Compression Therapy

- 12.3.2 Surgery

- 12.3.3 Laser Therapy

- 12.3.4 Pharmacologic Therapy

- 12.3.5 Multi-modal Home Therapy Devices

- 12.3.6 Other Treatment Types

- 12.4 North America Lymphedema Treatment Market Value, by Type (2021-2035)

- 12.4.1 Secondary Lymphedema

- 12.4.2 Primary Lymphedema

- 12.5 North America Lymphedema Treatment Market Value, by Affected Area (2021-2035)

- 12.5.1 Lower Extremity

- 12.5.2 Upper Extremity

- 12.5.3 Genitalia

- 12.6 North America Lymphedema Treatment Market Value, by End User (2021-2035)

- 12.6.1 Hospitals

- 12.6.2 Specialty Clinics

- 12.6.3 Ambulatory Surgical Centers

- 12.6.4 Homecare Settings

- 12.6.5 Other End Users

Chapter 13 Europe Lymphedema Treatment Market

- 13.1 Overview

- 13.2 Europe Lymphedema Treatment Market Value, by Country (2021-2035)

- 13.2.1 UK

- 13.2.2 Germany

- 13.2.3 France

- 13.2.4 Spain

- 13.2.5 Italy

- 13.2.6 Russia

- 13.2.7 Rest of Europe

- 13.3 Europe Lymphedema Treatment Market Value, by Treatment Type (2021-2035)

- 13.3.1 Compression Therapy

- 13.3.2 Surgery

- 13.3.3 Laser Therapy

- 13.3.4 Pharmacologic Therapy

- 13.3.5 Multi-modal Home Therapy Devices

- 13.3.6 Other Treatment Types

- 13.4 Europe Lymphedema Treatment Market Value, by Type (2021-2035)

- 13.4.1 Secondary Lymphedema

- 13.4.2 Primary Lymphedema

- 13.5 Europe Lymphedema Treatment Market Value, by Affected Area (2021-2035)

- 13.5.1 Lower Extremity

- 13.5.2 Upper Extremity

- 13.5.3 Genitalia

- 13.6 Europe Lymphedema Treatment Market Value, by End User (2021-2035)

- 13.6.1 Hospitals

- 13.6.2 Specialty Clinics

- 13.6.3 Ambulatory Surgical Centers

- 13.6.4 Homecare Settings

- 13.6.5 Other End Users

Chapter 14 Asia Pacific Lymphedema Treatment Market

- 14.1 Overview

- 14.2 Asia Pacific Lymphedema Treatment Market Value, by Country (2021-2035)

- 14.2.1 China

- 14.2.2 Japan

- 14.2.3 India

- 14.2.4 South Korea

- 14.2.5 Australia

- 14.2.6 Southeast Asia

- 14.2.7 Rest of Asia Pacific

- 14.3 Asia Pacific Lymphedema Treatment Market Value, by Treatment Type (2021-2035)

- 14.3.1 Compression Therapy

- 14.3.2 Surgery

- 14.3.3 Laser Therapy

- 14.3.4 Pharmacologic Therapy

- 14.3.5 Multi-modal Home Therapy Devices

- 14.3.6 Other Treatment Types

- 14.4 Asia Pacific Lymphedema Treatment Market Value, by Type (2021-2035)

- 14.4.1 Secondary Lymphedema

- 14.4.2 Primary Lymphedema

- 14.5 Asia Pacific Lymphedema Treatment Market Value, by Affected Area (2021-2035)

- 14.5.1 Lower Extremity

- 14.5.2 Upper Extremity

- 14.5.3 Genitalia

- 14.6 Asia Pacific Lymphedema Treatment Market Value, by End User (2021-2035)

- 14.6.1 Hospitals

- 14.6.2 Specialty Clinics

- 14.6.3 Ambulatory Surgical Centers

- 14.6.4 Homecare Settings

- 14.6.5 Other End Users

Chapter 15 Latin America Lymphedema Treatment Market

- 15.1 Overview

- 15.2 Latin America Lymphedema Treatment Market Value, by Country (2021-2035)

- 15.2.1 Brazil

- 15.2.2 Argentina

- 15.2.3 Rest of Latin America

- 15.3 Latin America Lymphedema Treatment Market Value, by Treatment Type (2021-2035)

- 15.3.1 Compression Therapy

- 15.3.2 Surgery

- 15.3.3 Laser Therapy

- 15.3.4 Pharmacologic Therapy

- 15.3.5 Multi-modal Home Therapy Devices

- 15.3.6 Other Treatment Types

- 15.4 Latin America Lymphedema Treatment Market Value, by Type (2021-2035)

- 15.4.1 Secondary Lymphedema

- 15.4.2 Primary Lymphedema

- 15.5 Latin America Lymphedema Treatment Market Value, by Affected Area (2021-2035)

- 15.5.1 Lower Extremity

- 15.5.2 Upper Extremity

- 15.5.3 Genitalia

- 15.6 Latin America Lymphedema Treatment Market Value, by End User (2021-2035)

- 15.6.1 Hospitals

- 15.6.2 Specialty Clinics

- 15.6.3 Ambulatory Surgical Centers

- 15.6.4 Homecare Settings

- 15.6.5 Other End Users

Chapter 16 Middle East & Africa Lymphedema Treatment Market

- 16.1 Overview

- 16.2 Middle East & Africa Lymphedema Treatment Market Value, by Country (2021-2035)

- 16.2.1 Saudi Arabia

- 16.2.2 UAE

- 16.2.3 South Africa

- 16.2.4 Rest of Middle East and Africa

- 16.3 Middle East & Africa Lymphedema Treatment Market Value, by Treatment Type (2021-2035)

- 16.3.1 Compression Therapy

- 16.3.2 Surgery

- 16.3.3 Laser Therapy

- 16.3.4 Pharmacologic Therapy

- 16.3.5 Multi-modal Home Therapy Devices

- 16.3.6 Other Treatment Types

- 16.4 Middle East & Africa Lymphedema Treatment Market Value, by Type (2021-2035)

- 16.4.1 Secondary Lymphedema

- 16.4.2 Primary Lymphedema

- 16.5 Middle East & Africa Lymphedema Treatment Market Value, by Affected Area (2021-2035)

- 16.5.1 Lower Extremity

- 16.5.2 Upper Extremity

- 16.5.3 Genitalia

- 16.6 Middle East & Africa Lymphedema Treatment Market Value, by End User (2021-2035)

- 16.6.1 Hospitals

- 16.6.2 Specialty Clinics

- 16.6.3 Ambulatory Surgical Centers

- 16.6.4 Homecare Settings

- 16.6.5 Other End Users

Chapter 17 Company Profiles and Market Share Analysis: (Business Overview, Market Share Analysis, Products/Services Offered, Recent Developments)

- 17.1 medi GmbH & Co. KG

- 17.2 PAUL HARTMANN AG

- 17.3 3M Company

- 17.4 AIROS Medical Inc.

- 17.5 Riancorp Pty Ltd

- 17.6 KOYA Medical

- 17.7 Huntleigh Healthcare Ltd. (Arjo)

- 17.8 Tactile Medical

- 17.9 Mego Afek Ltd.

- 17.10 SIGVARIS GROUP

- 17.11 ThermoTek Inc.

- 17.12 L&R Group

- 17.13 HERANTIS PHARMA Plc

- 17.14 Bio Compression Systems Inc.

- 17.15 Lympha Press

- 17.16 BiaCare Medical LLC

- 17.17 Others